All Categories

Featured

Table of Contents

Making use of the above example, when you take out that very same $5,000 finance, you'll gain returns on the entire $100,000. It's still fully funded in the eyes of the common life insurance company. For limitless financial, non-direct acknowledgment plan financings are perfect. It's critical that your plan is a mixed, over-funded, and high-cash worth plan.

Riders are extra features and benefits that can be contributed to your policy for your certain demands. They allow the policyholder purchase extra insurance policy or change the conditions of future purchases. One factor you may want to do this is to plan for unforeseen health issue as you get older.

If you toss in an extra $10,000 or $20,000 upfront, you'll have that cash to the financial institution initially. These are just some steps to take and think about when establishing your lifestyle banking system. There are numerous different means in which you can take advantage of way of life banking, and we can assist you discover te best for you.

Infinite Banking Insurance Policy

When it comes to financial preparation, entire life insurance policy often attracts attention as a popular alternative. Nonetheless, there's been a growing pattern of marketing it as a device for "boundless financial." If you have actually been checking out entire life insurance coverage or have discovered this idea, you may have been informed that it can be a way to "become your very own bank." While the concept might appear attractive, it's critical to dig much deeper to understand what this actually suggests and why viewing whole life insurance policy this way can be deceptive.

The concept of "being your very own bank" is appealing due to the fact that it recommends a high level of control over your financial resources. Nevertheless, this control can be imaginary. Insurance provider have the supreme say in exactly how your plan is taken care of, including the terms of the financings and the prices of return on your cash worth.

If you're taking into consideration entire life insurance policy, it's vital to watch it in a more comprehensive context. Whole life insurance policy can be an important device for estate preparation, supplying an assured death benefit to your recipients and potentially offering tax advantages. It can also be a forced financial savings automobile for those that struggle to conserve money regularly.

It's a form of insurance coverage with a cost savings part. While it can provide constant, low-risk development of money value, the returns are typically lower than what you could attain with other financial investment vehicles. Prior to delving into whole life insurance policy with the concept of boundless banking in mind, make the effort to consider your monetary objectives, risk resistance, and the complete variety of financial products offered to you.

Boundless financial is not an economic panacea. While it can operate in particular circumstances, it's not without dangers, and it calls for a significant dedication and understanding to manage effectively. By recognizing the prospective pitfalls and understanding truth nature of whole life insurance policy, you'll be better geared up to make an enlightened decision that sustains your financial health.

Rather than paying banks for points we require, like automobiles, homes, and school, we can purchase means to keep more of our cash for ourselves. Infinite Financial approach takes a cutting edge method towards personal money. The method essentially entails becoming your own bank by using a dividend-paying entire life insurance policy plan as your financial institution.

Infinite Banking Concept Dave Ramsey

It supplies significant development gradually, transforming the common life insurance policy plan right into a sturdy economic tool. While life insurance policy firms and banks risk with the fluctuation of the marketplace, the negates these dangers. Leveraging a money worth life insurance policy, people delight in the benefits of assured development and a death benefit shielded from market volatility.

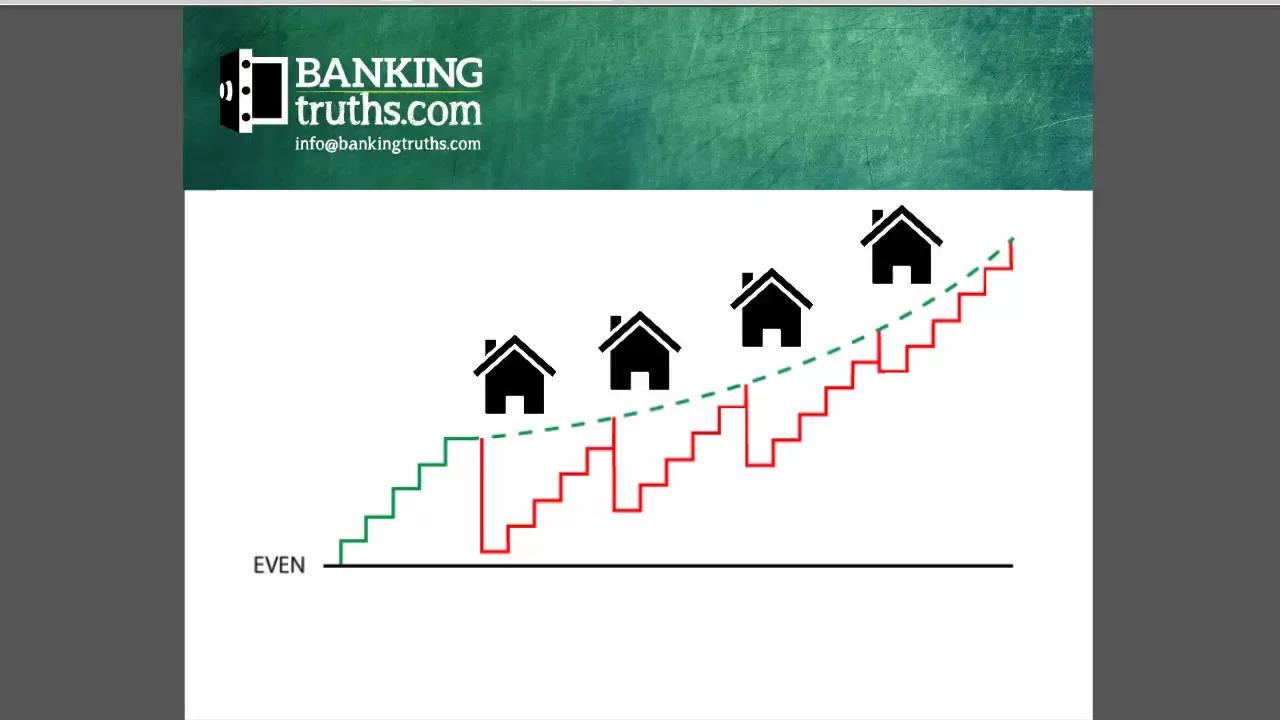

The Infinite Banking Idea highlights how much wealth is permanently transferred far from your Family or Service. Nelson also goes on to discuss that "you fund everything you buyyou either pay passion to somebody else or provide up the interest you can have otherwise gained". The genuine power of The Infinite Financial Idea is that it fixes for this issue and empowers the Canadians that embrace this principle to take the control back over their financing needs, and to have that money flowing back to them versus away.

This is called shed chance price. When you pay cash money for things, you permanently offer up the possibility to make rate of interest by yourself cost savings over numerous generations. To fix this issue, Nelson produced his very own financial system with using dividend paying participating whole life insurance policy policies, ideally via a common life business.

Therefore, insurance policy holders need to thoroughly evaluate their economic goals and timelines prior to going with this strategy. Sign up for our Infinite Financial Training Course. Regain the interest that you pay to banks and finance firms for the significant things that you need throughout a life time. Develop and maintain your Personal/ Organization wide range without Bay Road or Wall Surface Road.

Infinite Banking Agents

How to obtain Undisturbed Intensifying on the routine contributions you make to your savings, emergency fund, and retirement accounts Just how to place your hard-earned cash so that you will certainly never have another sleepless evening worried concerning exactly how the markets are going to respond to the next unfiltered Governmental TWEET or global pandemic that your family just can not recover from Just how to pay on your own initially using the core concepts shown by Nelson Nash and win at the money video game in your very own life Exactly how you can from 3rd event banks and loan providers and move it right into your very own system under your control A structured way to make certain you pass on your wide range the method you want on a tax-free basis How you can move your cash from permanently strained accounts and change them right into Never taxed accounts: Listen to precisely just how individuals simply like you can implement this system in their own lives and the effect of putting it right into activity! The period for establishing and making considerable gains via boundless banking largely depends on various aspects distinctive to a person's financial position and the policies of the monetary organization providing the service.

A yearly reward settlement is one more huge benefit of Unlimited banking, further highlighting its appearance to those geared towards long-lasting financial development. However, this strategy requires cautious consideration of life insurance expenses and the analysis of life insurance policy quotes. It's crucial to examine your debt record and confront any type of existing bank card financial obligation to make certain that you remain in a favorable placement to adopt the method.

An essential facet of this strategy is that there is ignorance to market changes, because of the nature of the non-direct acknowledgment fundings used. Unlike financial investments connected to the volatility of the marketplaces, the returns in boundless banking are steady and foreseeable. However, extra cash over the costs repayments can also be included in speed up development.

Infinite Banking Concept Dave Ramsey

Insurance holders make regular premium settlements right into their participating whole life insurance policy policy to maintain it in pressure and to construct the policy's overall money value. These superior payments are usually structured to be constant and foreseeable, making certain that the policy stays active and the cash money worth continues to grow in time.

The life insurance coverage plan is developed to cover the whole life of a specific, and not simply to help their beneficiaries when the specific dies. That claimed, the policy is taking part, meaning the policy owner becomes a part owner of the life insurance coverage company, and takes part in the divisible profit created in the kind of returns.

"Right here comes Income Canada". That is not the case. When dividends are chunked back into the plan to buy paid up additions for no additional expense, there is no taxable event. And each paid up enhancement additionally obtains returns every year they're proclaimed. Currently you might have heard that "returns are not assured".

Latest Posts

Wealth Squad Aloha Mike On X: "Become Your Own Bank With ...

Be Your Own Bank With Life Insurance

How To Be Your Own Banker